How France is keeping economic control over its former empire

The CFA Franc, a currency used in West and Central Africa, still raises questions about whether or not Africa has truly been decolonised

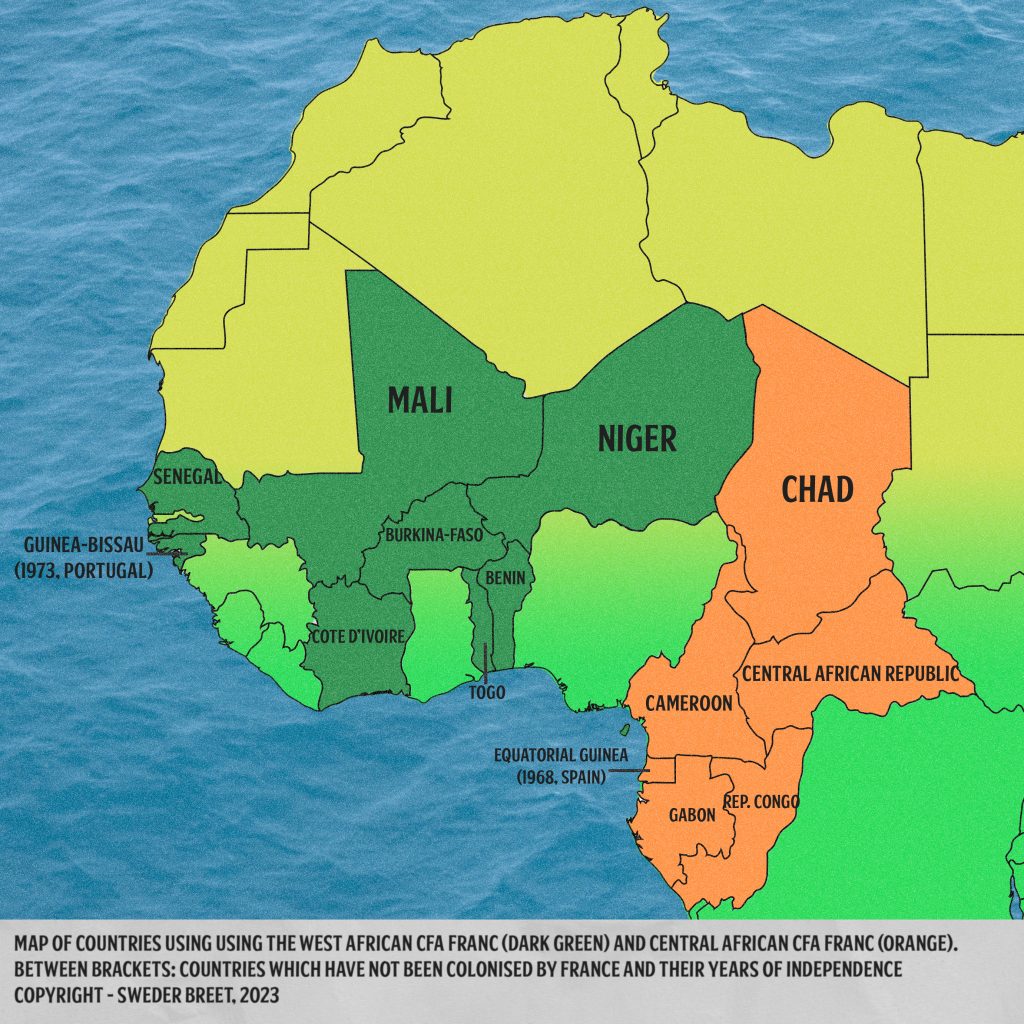

The CFA Franc (Communauté Financière Africaine Franc/Franc of the African Financial Community) is one of the dominant currencies prevalent in Africa, having been adopted by eight countries in the West African region (West African Franc) and six in Central Africa (Central African Franc). Their use allows for a stable currency in the West and Central African regions, given that the exchange rate of the CFA Franc against the Euro is set at a fixed amount (1 Euro = 655.957). The two currencies will therefore always keep the same value compared to the Euro, facilitating trade between France and the countries using the CFA Franc. This might seem like an ideal way to unite neighbouring countries with a common currency similar to the Eurozone but the CFA Franc hides some dark secrets originating from the era of the French colonisation of Africa and which colonial legacy still holds a grasp over its former colonies, even though these countries have officially been “decolonised”.

In 1945, shortly after the end of the Second World War, France created the CFA Franc by order of General De Gaulle. The reason behind the creation of this new currency for French colonies was the fact that the French Franc became tied to the US Dollar after the Bretton Woods agreement, devaluing the Franc. In order to avoid a devaluation of the Franc in the colonies, the CFA Franc was created, one for France’s West African colonies and one for its Central African colonies. These new currencies would, in theory, improve economic integration between the colonies and mainland France and facilitate the exchange of goods and resources. In reality, the creation of the CFA Francs allowed the French government to easily import resources from Africa in order to reconstruct the French mainland. Besides linking the CFA Francs to the French Franc, the French government also printed the CFA Franc in France, which it continues to do to this day.

(In)dependence?

In the months and year leading up to the independence of France’s colonies in Africa in 1960, the French government created the Central Bank of West African States (Banque Centrale des Etats de l’Afrique de l’Ouest, BCEAO) and Central Bank of Equatorial African States and Cameroon (Banque Centrale des Etats de l’Afrique Equatoriale et du Cameroun, BCEAEC). These two banks were responsible for issuing CFA Francs and holding the financial reserves of the soon-to-be independent countries. By printing and holding the money of their former colonies, France is still able to hold a certain level of control over what is happening in their former colonies. Even though the currencies can be converted to Euros for fixed rates, the Central and West African Francs are not inter-(ex)changeable. This limits the amount of economic cooperation between the two currency zones but ensures that the countries in the two currency regions will always have the ability to continue trade with France and Europe as a whole.

Besides the fact that France is printing both the Central and Western African CFA’s, France also held half of the foreign exchange reserves of countries using the West African CFA up until 2020. The country is still holding the exchange reserves of Central African countries using the CFA. Holding foreign exchange reserves in a foreign country severely limits the ability of nations, in this case, the users of the CFA Franc, to control their own economies. The French government can therefore influence the monetary policies of the countries using the CFA Franc, which takes away from the sovereignty of CFA Franc users and is seen as a “humiliating dependence” on France and one of the vestiges of French colonialism.

Of course, it is important to look at what that power is being used for exactly. The answer is exactly what brought France to the African continent in the first place several centuries ago. Resources.

However, in the modern day, the French government does not aim to import mass amounts of tropical produce, even though this trade is still relevant in the current day. The main resources that France imports from CFA Franc countries in the 21st century are for their own industries. Uranium from Niger is crucial for powering French nuclear power plants and rare minerals such as chromium and manganese are important elements for the French aviation and weapon industry.

Because the CFA Francs are fixed to the Euro, it is very cheap for French companies to import resources from Africa and sell their products at a lower cost. CFA countries are still being exploited by their former colonizer in order to get access to their rare resources. As Ndongo Samba Sylla said, the CFA Franc is only a good currency for those who benefit from it.

Although it is easy to give a one-sided view, especially on current-day issues, it should be mentioned that the CFA Francs have indeed given the two regions more financial stability and economic cooperation with Europe compared to certain neighbouring countries. Even though the currency is very flawed and mostly works for the benefit of French interests, positive developments have resulted from the debate about the future use of the CFA Franc.

The countries using the Central African CFA are working to make adjustments to their currency in order for it to become more equal and beneficial for them, including changing its name and a gradual retreat of French institutions from the currency. This will also be done in cooperation with the French government, which stated that it would be open and available to discuss reforms of the currency. For West African states, the discussion about the CFA Franc has sparked the possibility of establishing a new common currency called the Eco, including Nigeria and Ghana as well. This will further improve economic integration in West Africa and can allow for the creation of a stable trading alliance. According to a roadmap from ECOWAS (Economic Community of West African States), the Eco should replace the CFA Franc by 2027.

A lasting legacy

It can be said that the CFA Franc is still a remnant of the French colonial empire and a tool for France to keep control over their former colonies. The currencies were created during the times when France was seeking to maintain control over their colonies after the Second World War and were designed from the start to be more beneficial to France than to the nations using them domestically. This trend has not changed in the past sixty years that the now independent countries have been using the currencies, with France having the ability to control money flows and policies in West and Central Africa. The fact that France is printing CFA Francs and keeping half of the foreign exchange reserves of CFA countries in French banks allows them to take away sovereignty from these African countries, while at the same time benefiting from favourable import and export rates for rare resources and manufactured goods due to the CFA Franc’s link to the Euro. These controversial terms of the CFA Franc have caused debate among African intellectuals and governments, with some deciding to distance themselves from the currency and, by extent, France’s influence over the continent. Debates about the future of the CFA Franc and potential new currencies have resulted in some innovative ideas regarding the future of regional African economics and integration. Perhaps in the near future, Africa can finally lose some of the last vestiges of French colonialism on the continent.

Leave a comment

You must be logged in to post a comment.